Estate Tax = Death Tax: Burden of our Beneficiaries

All of us will die. It is just a matter of time. Some will go sooner and some will go later. But at the end of the day, what matters is we have everything planned and covered for the people we will leave behind.

It can be in the form of a will, life plan, memorial plan for our wake and burial or cremation. But it is also important to have insurance which can be used by our beneficiaries to pay for estate tax.

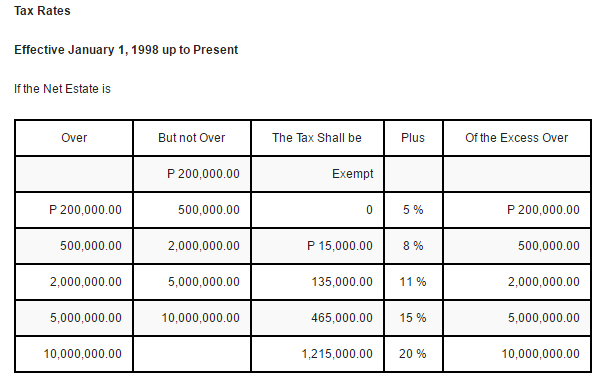

Even in death, there is tax. Upon our death, all our assets will be frozen and put on hold by the government until our beneficiaries are able to provide all the requirements which can be found in the link: http://www.bir.gov.ph/index.php/tax-information/estate-tax.html. More importantly, they will need to pay the estate tax based on the table below:

In simple terms, here is the equivalent estate tax our beneficiaries need to pay for selected scenarios of the net estate worth:

| Net Estate Worth | Estate Tax to be Paid |

| 200,000 | 0 |

| 400,000 | 10,000 |

| 1,000,000 | 55,000 |

| 4,000,000 | 355,000 |

| 9,000,000 | 1,065,000 |

| 12,000,000 | 1,615,000 |

Note that this is just estate tax and excludes other taxes like transfer tax and other incidental costs like hiring a lawyer, going to the government and private offices for the processing of the transfer of the estate from the deceased to the beneficiaries (e.g., going to COL office for submission of requirements), etc.

In order for our beneficiaries to pay for the estate tax, we need to ensure that our insurance coverage will be enough for them to be able to use it to pay for the estate tax otherwise all our hard work will be in vain. I remember one friend will always life insurance is love. So, if you love your family get the right insurance coverage. 🙂

One thought on “Estate Tax = Death Tax: Burden of our Beneficiaries”

Sell your home and just rent. If I am not mistaken, you can declare your rental fees. see to it you have enough money to pay all your depts, ans also be prepare for all funral expenses. Do not leave the responsibilities to your children. Am I right? 😉