Investing in Education

This is a reposting. The original blog was posted last Nov 2012.

I am fortunate that in my career I joined two companies, P&G and the Happiness Factory, that invests in training people not only in the tools we can use in our daily work, e.g., SAP training or MS Excel Course training, but also training us on soft skills which will help to improve our personal and work life and thus deliver sustainable successful results. In the Happiness Factory, one of the courses that are mandatory for all employees to attend is the 7 Habits for Highly Effective People. I am one of the pioneer employees in this green field project but for some reason or the other it is only now that I am taking up this course. I am actually thankful for the delay because I am more prepared now to accept and apply this training in my own personal life.

Attending the training on 7 Habits for Highly Effective People has reinforced what I have done the past few months and that is to take control of my financial life and create my dream board or as they called it in the training “personal mission statement.”

By showing you my dream board in my first blog, I am opening myself to you and this is not an easy task for me as I am a very private person. Though I am very talkative, I usually don’t talk about my private life. I am more of a listener (am a frustrated Psychologist and Guidance Counselor).

Anyway, why did I share with you my dream board?

1) Because I want to inspire you to take control of your life and plan what you want to achieve in life. Do a reflection and ask yourself “what is your mission and purpose in life?” I’m sure God has grand plans for us and that each one of us has a mission to do. It would be nice when you look back during your twilight years you will be smiling with a sense of accomplishment that you have done your part, however little it may be, to improve the society or the world.

2) Because I want you to assess at certain checkpoints if your actions are supporting those dreams you have. If not, then readjust your action or even readjust your goal. Up to you if you want to endure pain now and enjoy delayed gratification or you want to enjoy now and suffer later. This is like a continuous improvement initiative that we all are good in doing in our work life but don’t do or hardly do in our personal life and I am talking about the Plan-Do-Check-Act (PDCA) cycle (Am sure my peers in P&G are very familiar with this). In work, we also have Performance Plan wherein at the start of the year we do goal setting and have mid-year check point to check where we are and readjust goals or actions to make it more realistic and achievable though still a stretch target and finally we have an end of the year check if we were able to hit our objective. It is only recently that I wondered how come I don’t apply these things in my personal life. I will talk about my past habits and attitude in a separate article as it is too long to share with you the story here.

3) Because I am a work in progress and I need continuous support and affirmation that I can achieve my goals. That is why we have mentors and friends of the same mindset that we always need to connect with and touch base. We also need the support of our Family because they are our staunch supporters and worst critics. Our family is also our inspiration to achieve our goals and be one of the recipients of our generosity.

4) Because I want all Filipinos to be financially literate and we create the new Filipino character.

- Forget about the Mañana Habit or procrastination (Mamaya Na) and the fatalistic attitude of leaving it all to God (Bahala Na) that we have learned from the Spaniards.

- Wouldn’t you want to see the new Juan who has a take charge attitude, fully in control of his future and financial life and has the freedom to choose and who will choose to do things today? A new Juan who is financially savvy, who will not get conned into scams and invests in mutual funds and stocks.

5) Because if we are all financially successful we are helping the Philippine economy and we can also assist our less fortunate brothers and sisters. Wouldn’t you want to see in our lifetime the Philippines get upgraded from an emerging market to a developed market?

How do I achieve my goals in my dream board? I need to unlearn and relearn. I need to feed my mind, heart and spirit. I needed to forget about old habits and mindsets. I needed to create new mindsets and behaviors.

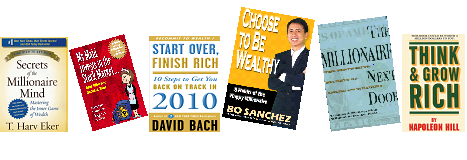

I think one the most important investment I have made is investing in my education regarding Finance for Dummies (e.g., investing time and money to attend seminar, buy and read books, articles in the Internet and blogs). I can never emphasize enough about education. This year I think I have attended so many financial coaching seminars (on top of the seminars sponsored by IMG and one of which was sponsored by TGFI) and also read so many financial literacy books and articles than I have ever done so in my past xx years existence in planet Earth. As Yanmar, one of my mentors in IMG would always love to show say in his financial coaching seminar, “Education is a race without a finish line.”

I never felt this kind of hunger for knowledge about Finance, Economics and Investing but I saw myself devouring books and articles even though how boring or challenging some of them could be. I started with Brother Bo Sanchez’ book “My Maid Invests in the Stock Market… And Why You Should Too!” This book actually rocked my core and challenged me. If they can do it, why can’t I do it? The feeling of being superior (in Tagalog, “angas”) because I had a college degree was being mocked and I took Bo’s challenge.

Maybe in my future articles, I would do a write up on my perceptions, thoughts, learning and key take away from the different books I have read. Another topic I may want to discuss in a future article is about the other important investment on the education regarding changing of mindsets and behaviors.

But for now, I leave you with the challenge to invest in your education on Finance 101 or Finance for Dummies, by reading books and articles in the Internet and attending seminars, as this is the only way that you can learn the best approach you can take for your own personal life.

“Formal education will make you a living; self-education will make you a fortune.”

— Jim Rohn