Wealth Management Series by Mr. Rex Mendoza & The Challenge of Finding the “Tipping Point”

I have been blessed that I had a chance to attend free seminars that featured top names in the Philippine investing world in the past 2 Saturdays c/o TGFI Web Academy and TGFI SG. Last blog post, I shared with you about “Investing in the Philippine Stock Market: A Webinar Conducted by Mr. Aya Laraya”, a webinar organized by TGFI Web Academy in cooperation with COL Financial. In today’s blog post, I will share with you about the:

May 2: Wealth Management Series by Mr. Rex Mendoza

“Learn how to manage your wealth and retire rich while working abroad. A good event for OFWs.”

Travelling from West to East and vice versa took a total of 3 hours via MRT (including my slow walking pace) to hear the charismatic Mr. Rex Mendoza speak in the flesh for around 2 hours non-stop. I was happy that there were a lot of fellow OFWs who attended the seminar but I was also a bit saddened that not all who registered showed up, to think it was a free seminar with free pizza and Coke merienda.

Mr. Mendoza covered the following topics but focused more importantly on the “YOU”.

Global Economic Scenario – covering US, Europe and China

Philippine Economic Scenario – covering how our economy is doing well coming from: OFW Remittances, Travel (although we do have a lot of foreign visitors we still can do a lot more in terms of promoting 7,100+ beautiful islands), BPO and Foreign Investors. But yet, 82% of Filipinos still save in banks widening the gap between the Savings and Investing ratio.

This year, Philippines is entering the demographic sweet spot window which means that the majority of the population are in the 15-65 years old range, where they are at their most productive life stage. This will last around 35 years and based on observations in other countries, like Japan (1960s), Singapore, Hong Kong and South Korea (1980s) and China and Thailand (1990s), when they entered the demographic sweet spot window their economy grew the fastest in their history, which signifies a correlation between the demographic sweet spot and the advancement in economic growth.

YOU

According to him, Filipinos have an inherent cultural problem when it comes to personal finance. Our biggest challenges are: 1) Discipline and 2) Financial Literacy – finding and getting instruments that will help you achieve you financial goals and beat inflation. Our main objective in investing is not just to achieve our financial goals and support our retirement but more critical is that our resources should outlast us.

Definition of “Wealth Management”: 1) Accumulation, 2) Preservation and 3) Transfer of Wealth (in the most tax efficient manner)

He briefly touched on Needs vs Wants. Giving the definition and saying that actually it is easy and is a no-brainer until you find yourself inside the STORE. The first and biggest mistake you can do is after entering the store you go and try on the clothes, shoes, etc and checking yourself out in the mirror to see if it fits you nicely or suits you perfectly. You are already sold to the product and what will completely seal the deal is hearing your friend or sales lady telling you it matches your hair, it perfectly blends with your skin making you look whiter, it fits you well and hides your curves in the wrong places. It made me think about myself.

It made perfect sense to me when Mr. Mendoza said “Understand the way you are behaving – match your strategy vs your plan.” I actually was a shopaholic before. It starts with nothing to do on a weekend so I go to the mall to just go window shopping but I end up going home with a few things that I bought because it was on sale, I got a good deal but worse is sometimes I end up not even using the item. When I started investing, I purposely minimized going to malls and if I do go I make sure I have an objective to buy or a shopping list and once done I either eat or I immediately go home.

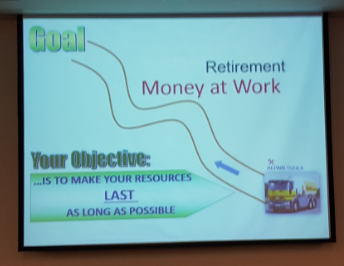

3 Stages in Life:

- Man at work – man working hard for the money (e.g., employment, business)

- Man and money at work – man investing his hard-earned money

- Money at work – man is retired and reaping the benefits of his investments

He said his presentation ended with the 3 Stages in Life but then he did reflection on the following things and changed it to 3 Stages in a Person’s Meaningful Life: But what is your deeper purpose? Why are you here on Earth? How can you add value to others or to society?

3 Stages in a Person’s Meaningful Life:

- Prospering Yourself

- Prospering Others

- Legacy, Significance, Glorifying God

This is my second time to hear him speak, the first one during Bo Sanchez’ Wealth Summit a few years back where I took away the revised Prosperity Formula: Income – Tithes – Investing= Expenses, where Investing replaced Saving. During the Wealth Summit, given that he is a great advocate of Mutual Funds, he delivered a few jokes at the expense of investing in stocks and Edward Lee.

Mr. Mendoza has not lost his touch. He continues to be a charismatic speaker who can really and effectively impart and teach personal finance with a touch of comedy and a lot harsh and direct statements that can really cut through the core. He says that, “Sometimes pain is a better teacher as pain drives behavioral change.”

I seriously believe this because as I look back there were 2 tipping points in my life which changed the way I handle my finances:

1) A wake up call from a friend asking if I have a huge savings because I was working overseas for 3 years and I had nothing to show for it so it motivated me to start saving

2) One year after I started saving, I realized that saving/time deposit alone will not help me fulfill my dreams and goals. It just fell into place that I got invited to a financial literacy seminar and given the perfect timing I just immediately started investing.

One of my friends has told me my tipping point or my pain was too complicated that maybe others don’t have the same complicated story. He told me his was very straightforward and gave me a challenge to understand the tipping point for a Filipino to change his mindset about personal finance. I invite you, dear reader, to share with me your story on why you decided to take control of your finances, what was your wake up call, what motivated you, what was your immediate action and what has been the outcome so far? You can share with me your story by sending me a pm via FB or email me at wengfeliciano[at]yahoo.com. I look forward to reading your story and let me know if you are open that I also share your story with others with the intent of inspiring more Filipinos to invest.

P.S. Special thank you to TGFI SG, Richard Macalintal and Rex Holgado for organizing the event, serving the food and taking the photos. 🙂

One thought on “Wealth Management Series by Mr. Rex Mendoza & The Challenge of Finding the “Tipping Point””

Thank you Weng for sharing your learnings fr Mr. Rex Mendoza. Sad that I wasn’t able to attend but your article is a good consolation to my absence on that day. Just like you, I just realize one day, after I finally do my cash flow resulting to negative, that Im wasting my being an OFW with mindless buying. Now, my motivation to invest is to help the PH economy in the future, in my own small way, and not to be financially dependent upon golden days. Thnks for this article, cheers to a #FinanciallyLiteratePH