Another Saving System – T. Harv Eker’s JARS Money Management System

Last Dec 2014, I started a series on savings, the definition of savings, the prosperity formula, why is saving important and started to share the different ways of saving like:

- Collecting Coins – Put all coins in a coin bank and deposit once full (Variation: choose largest coin amount like S$5)

- 52-week challenge inspired by a post from Facebook

- 12-month challenge

Today, I will share with you T. Harv Eker’s JARS Money Management System from his book “Secrets of the Millionaire Mind”. Eker’s seminar “Millionaire Mind Intensive” teaches and discusses this simple and effective money management method.

In Singapore, he will be holding this seminar in March 20th to 22nd. If interested, go to this link for more information http://www.millionairemindsg.com/. I am not paid for this advertising but I just want to share this with you if you want to go more in-depth in the JARS Money Management System as I will be just giving an overview in this article.

Note that some people use jars and some use envelopes. Do whatever works for you.

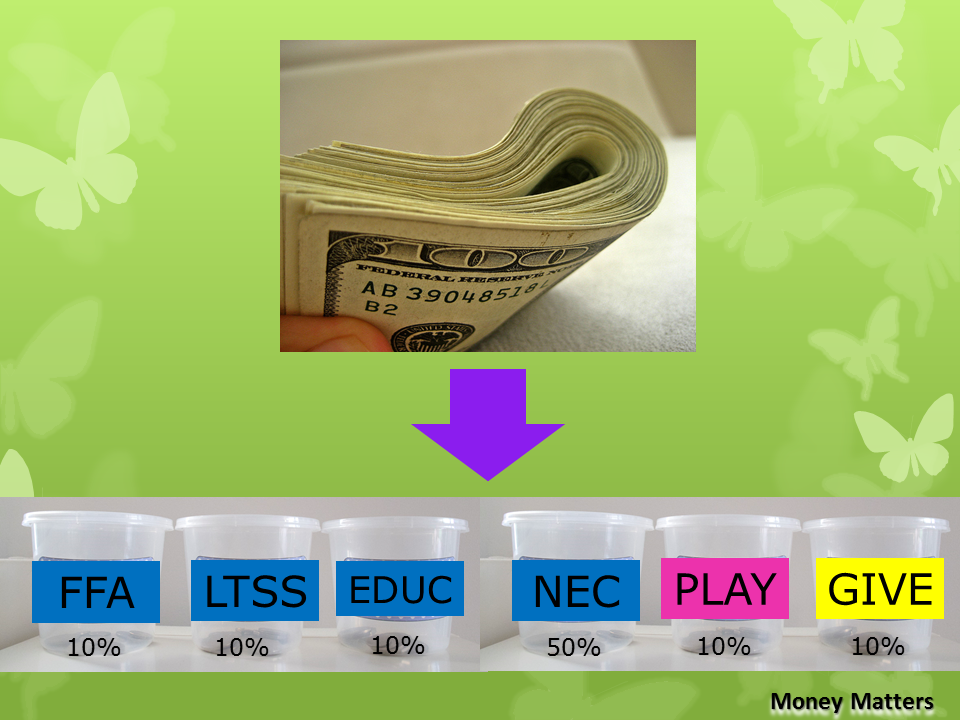

What Eker is advocating is that every time we receive an amount of money whether from your salary, bonus or other source of income, divide it accordingly to the following:

- Financial Freedom Account (FFA) = 10%

FFA fund will be used for long-term investing or creating businesses which will generate passive income.

- Long Term Savings For Spending (LTSS) = 10%

LTSS fund will be used for major expenditures like buying a house, travel and saving for an emergency fund.

- Education (EDUC) = 10%

Education fund will be the money used for investing in knowledge via books, seminars or coaching.

- Necessities (NEC) =50%

I can hear you saying, “Wow! Only 50%? How to survive?” This means we need to simplify our lifestyle and find the areas we are excessively spending for.

Also, we will need to adapt the thinking of “delayed gratification” which is a bit of a challenge in this very fast paced world. I said it’s a bit of challenge but not impossible. Take it from a used-to-be spender like me.

- Play (PLAY)= 10%

Play fund must be used up every month. It is a way for you to nurture, pamper and reward yourself. We need to take of the golden goose, which in this case is ourselves.

You can use this to treat yourself to a movie, spa, manicure, pedicure, play bowling or billiards with friends or even luxurious activities like renting a boat or staycation in a hotel for the weekend.

We all need to take a well-deserved break once a month to keep ourselves from succumbing to stress and pressure.

- Give (GIVE) = 10%

Give fund is similar to the Love Offering I shared in my blog https://wengfeliciano.wordpress.com/2014/10/24/savings-foundation-for-creating-wealth/.

It is up to you what percentage you want to give but I always believed that the universe will reward you if you do something good so even if it hurts as the amount may seem to big just have faith that you will receive it back.

Like for me, it’s been a struggle but this year I have committed to the 10%. It is my way of saying thank you for the abundant blessings I have received for the past few years especially after I have started investing.

T. Harv Eker’s system is unique in a way that it provides for Play and Education. His thinking is that we need to have balance and there needs to be a holistic approach where our inner self will not feel it has been neglected because all we think about is save, save, save.

If you sign up for his Life Makeover Coaching, you will hear all about this balance that he also focuses not just on health, financial but also space (being clutter free or have more orderliness not only in our house but also in our gadgets like camera, phone, computer), relationships and spiritual, among other things.

Anyway, going back to saving, if you understand your Emotional Why as to why you want to have a handle on your money management then, although things are still difficult, it will be more acceptable because you have a bigger picture that you are envisioning in your mind.

That’s why I invite you to either write down all your goals with specific timelines or put it in a collage like a Dream Board. This will reinforce your reason for saving and for embarking on this change in your financial life.